Government Schemes

Introduction

Drive into a greener future with BankIslami’s PAVE Finance. This Shariah-compliant initiative, part of the Government of Pakistan’s Pakistan Accelerated Vehicle Electrification (PAVE) program, makes green technology accessible and affordable. By replacing high fuel costs with the efficiency of electric power, you can significantly reduce your daily operational expenses.

Purpose

This program helps individuals and small business owners escape the stress of rising petrol prices by switching to electric vehicles. By offering affordable, digital-based financing at subsidized rates, we are helping our customers save money on daily fuel costs and build a more sustainable future.

Financing

Financing of up to PKR 200,000 for e-Bikes (two-wheelers) and up to PKR 880,000 for e-Rickshaws / e-Loaders (three-wheelers).

Equity Participation

Finance-to-Equity ratio of 80:20

Pricing

End-User Profit Rate: 0%

Processing Charges

No Processing Charges

Tenure

Financing tenure is set for a maximum of 2 years for e-Bikes and up to 3 years for e-Rickshaws and e-Loaders.

Security

- Financed vehicle itself serves as the mandatory collateral

- Vehicle will be marked with Hypothecation (HPA) in favor of BankIslami

Eligibility

- All citizens of Pakistan (including GB & AJK)

- Age limit: 18–65 years for e-Bikes

- Age limit: 21–65 years for e-Rickshaws and e-Loaders

Takaful

Comprehensive Takaful is mandatory. First year’s cost is taken in advance, while subsequent years are pro-rated into monthly installments.

Digital Application Submission

The entire solicitation process is initiated via the PITB digital portal, where customers apply online and select BankIslami as their preferred institution.

How to Apply

The application process is handled through a digital-first platform with minimal human interaction.

Apply Now via the Official PAVE Portal: https://pave.gov.pk/home

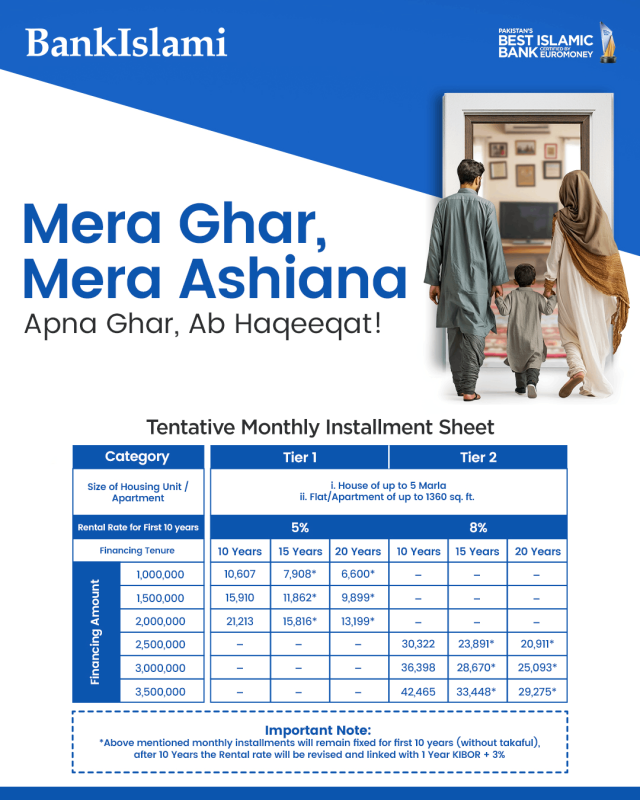

In an effort to make housing more accessible and affordable, the Government of Pakistan has launched the “Mera Ghar – Mera Ashiana (MGMA)” scheme, offering profit subsidy to support first-time home owners. BankIslami extends this facility through Muskun Home Financing, enabling individuals to construct or purchase their dream homes with ease, convenience, and complete Shariah compliance under the Diminishing Musharakah structure

· Pakistani CNIC holding citizens · First time homeowners · Not owning any housing unit in their name · Purchase of house/flat · Construction of house on already owned plot · Purchase of plot and construction of house · House of up to 5 Marla · Flat/Apartment of up to 1360 sq. ft. area · Salaried: 25 – 60 Years · SEP/ Businessmen: 25 – 65 Years

Mera Ghar Mera Ashiana (MGMA)

Mera Ghar Mera Ashiana Parameters:

Parameters

Tier 1 (up to 2 Mn Cases)

Tier 2 (Above 2 Mn up to 3.5 Mn Cases)

Eligibility Criteria

Scope

Size of Housing Unit

Maximum Financing Amount

Up to PKR 2.0 Million (Tier 1)

Above PKR 2.0 Million and up to PKR 3.5 Million (Tier 2)

Maximum Financing Tenor

20 years (subsidy for 10 years)

Age

Bank Pricing for Subsidy

Bank will claim subsidy amount being the differential of Customer pricing and prevailing 1 Year KIBOR + 3%.

Customer pricing (Initial 10 Years)

5% (Tier 1)

8% (Tier 2)

Customer pricing (After 10 to 20 Years)

One Year KIBOR + 3%

Processing Fee

Nil

Early Termination Charges

Nil

Minimum Contribution from the customer

Minimum 10%

Risk Coverage

10% of the outstanding portfolio under the scheme on first loss basis

Financing Cities

Whole of Pakistan

Monthly Income

No Upper and Lower limits on the ‚income requirement‛