- Purchase

- Construction

- Renovation

- Replacement

- Glossary: (Muskun Finance)

- Exclusive Home Financing Offer

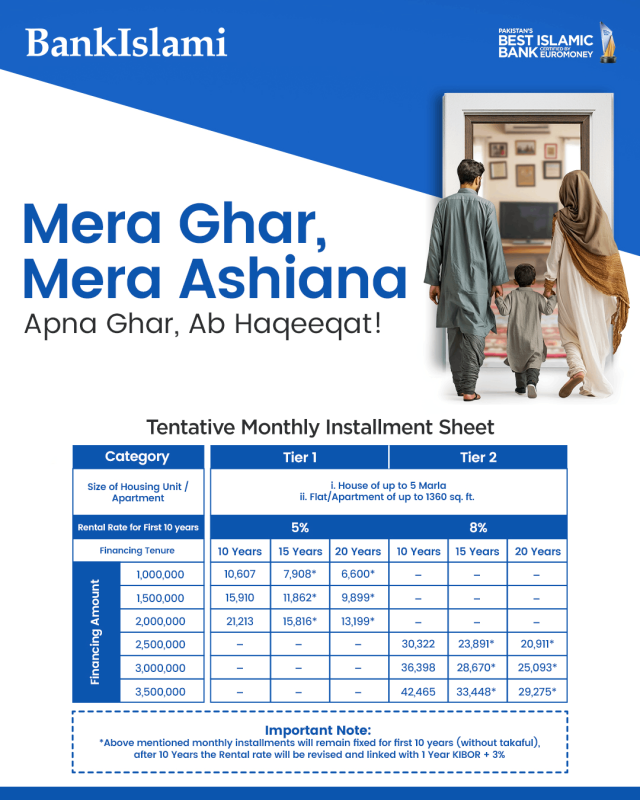

- Mera Ghar Mera Ashiana 2

Features:

Just point your finger at the Bungalow or Apartment of your choice and we’ll help you buy it.

| Financing Tenure | 2 to 25 years |

| Financing Range | Rs. 200K – 150M |

| Bank Investment Ratio | Maximum up to 75% for salaried Maximum up to 75% for SEP * (* Doctors, Engineers, Architectures, Chartered Accountants)Maximum up to 75% for Business persons/NRPs |

| Prepayment Option available | 5% if the Facility is settled in the 1st Year

NIL if the Facility is settled after the 1st Year |

The MUSKUN Home financing facility is based on the principle of Diminishing Musharakah and Ijarah. The Diminishing Musharakah transaction is based on Shirkat-ul-Milk where you and the Bank participate in ownership of a property.

The share of the bank is then leased to you on the basis of Ijarah and is divided into a number of units. It is then agreed that you will buy the units of the bank periodically, thereby increasing your own share till all the units of the Bank are purchased by you which will make you the sole owner of the property.

Till that time, you pay the Bank rent for its units leased to you. The rent keeps on decreasing as your ownership in the property increases and that of the Bank decreases.

Benefits:

Quick Processing

Flexibility to make partial prepayments

Flexible & affordable installments

Clubbing of family income

No negative area

To Understand the Difference between Diminishing Musharakah and Conventional Long Term Financing kindly click the link

How It Works?:

- You will approach BankIslami and inform about your needs of financing for Home Purchase, Construction, Renovation or Balance transfer facility.

- You will then submit the filled Application Form along with the required documents and a cheque for processing fee. Our Business Executive will guide you during the whole process.

- The Bank will conduct verification of your residence & office addresses as well as those of the references provided by you.

- The Bank will then conduct your Income estimation to determine the maximum financing that can be provided to you.

- In case you are Self Employed, our agent will approach you for the necessary income details and documents.

- In case you are Salaried, we will approach your employer for this purpose.

- A legal opinion is then obtained by the Bank on the property documents submitted by you. Valuation of the property is done to determine its Market value.

- The Bank then issues you an offer letter for the financing amount you qualified for based on your evaluation.

- After your acceptance, a Shirkat-ul-Milk (Musharaka) Agreement is signed between you and the Bank, whereby, the Bank and you will become joint owners (partners) in the Musharakah property.

- A Pay Order is issued in the name of the seller in case of MUSKUN Home purchase by the bank. Your Business Executive and our in house / External lawyer will accompany you for the transfer of property in your name. The Pay Order is then handed over to the seller. In case of MUSKUN Home Construction / Renovation / Replacement cases, the financing amount is simply credited to your account. It is ensured through Shariah-compliance checks that the funds are utilized only for construction/renovation/replacement.

- You and the Bank also execute a Monthly Payment Agreement whereby you agree to pay a monthly payment to the Bank for the use of the bank’s ownership in home.

- Undertaking to Purchase is given by you, under which you undertake to purchase the Musharakah Units (representing Bank’s undivided ownership share in the property) from the Bank periodically.

- On monthly basis, you purchase Musharakah units from the Bank. When you have purchased all units of Bank, you become the sole owner with a free and clear title to your home.

- When you have purchased all units of Bank, you become the sole owner with a free and clear title to your home.

Eligibility:

| Citizenship | Pakistani |

| Cities | All major cities where BankIslami Pakistan Limited Branch exist. |

| Age Limit | Salaried/Businessmen/Selected Professionals: Salaried Primary Applicant: 25-60 Years Businessmen Primary Applicant: 25-65 Years Co- Applicant: 21-70 Years NRPs: Primary Applicant: 25-60 Years. Co- Applicant: 21-70 Years. |

| Employment Tenure | Salaried: Minimum 6 months at current employment and 2 years continuous employment experience in the same industry/field. Businessmen: 3 years of business / practice. |

| Minimum Income | Salaried: Rs. 60,000/- NRPs: Rs. 80,000/- (The respective foreign currency must be equivalent to this amount) |

| Additional Criteria for NRPs | 1. An NRP needs to have a Co-applicant residing in Pakistan as an Authorized Person on behalf of the NRP. 2. Only Salaried NRPs can avail MUSKUN Home Financing. |

Documents Required

General

Copy of CNIC (Applicant and Co-applicant)

2 passport size photographs (Applicant and Co-applicant)

Completely filled Application form with Applicant’s Profile Report

Copies of Last 6 months paid utility bills

Property Documents

Copy of chain of all title documents

Approved Building plan

Public notice

For Salaried Persons

Employment certificate issued by employer

Last three Salary Slips

Bank Statement of last 12 months

Detail of other financing along with its repayment

For Businessmen

Income tax return for last three years , Proprietorship Letter/Partnership ded/ Memorandum and Articles of Association

Company Bank Statement of last 12 months

Detail of other financing along with its repayment

For NRPs

We offer NRPs (only Salaried segment) purchase/construct/renovate/balance transfer facility of a House/Property only in Pakistan only

Last three months Salary Slip

Copy of Passport

Copy of NICOP

VISA/residential status proof

Tax deduction details

Employment Certificate and Contract Copy

Bank Letter and Banks Statement of last 12 months

2 passport-sized colored Photographs of Applicant / Co-Applicant

All the above mentioned documents relating to NRP should be duly attested by Pakistani Consulate

Apply Now:

FAQs:

Q. What are the minimum and maximum financing limit for MUSKUN-Islami Home Financing?

Home Purchase: Rs. 200K – 150M

Q. What is the minimum and maximum tenure being offered by BankIslami?

Home Purchase 2-25 Years

Q. What condition would apply in case of Co-applicant case?

Co-applicant must be member of the immediate family i.e Spouse, Parents & Children only

Q. Which areas are considered “positive” for MUSKUN-Islami Home Financing?

No negative area is marked by BankIslami for MUSKUN-Islami Home Financing

Q. What is charged if pre-mature payment (early payment or termination) of MUSKUN-Islami Home Financing is done?

In case any pre-mature payment is done, Bank will sell the Musharakah units as follows:

• 5% if the Facility is settled in the 1st Year

• NIL if the Facility is settled after the 1st Year

Q. Who will assess the value of property?

We have our approved valuators for this purpose

Q. Will my spouse’s income also be considered?

Yes, 100% of your spouse’s income (Wife or Husband) can be clubbed for Debt burden calculation. In addition 50% of your sibling’s income can also be clubbed for Debt burden calculation

Q. Will BankIslami provide me financing for commercial purposes for example building a commercial plaza?

MUSKUN Home Financing is a Consumer-financing product and is only meant for residential purposes

Q. What are the application form & processing charges?

Please refer to SOC

Fatwa:

BankIslami’s commitment to Shariah is strict and absolute. Muskun Home financing products are approved and verified by our Shariah Board. To view our Shariah Board’s approval of Muskun Home Financing products, click on the following:

Do you Dream of providing your loved ones a home of their own but don’t have the funds?

Don’t stop dreaming, Let us make your Dream a Reality with BankIslami MUSKUN Home financing where you can avail financing for any of the following facilities:

So you want to build your Dream home rather than buy a ready made one? You make the design, we”ll help you build it.

| Construction Tenure | Maximum 2 Years |

| Financing Tenure | Minimum 2 Years (excluding construction period) Maximum 25 Years (excluding construction period) |

| Financing Range | Rs. 200K – 150M |

| Bank Investment Ratio | Maximum up to 75% for salaried Maximum up to 75% for SEP * (* Doctors, Engineers, Architectures, Chartered Accountants) Maximum up to 75% for Business persons/NRPs |

| Prepayment Option available | 5% if the Facility is settled in the 1st Year

NIL if the Facility is settled after the 1st Year |

The MUSKUN Home financing facility is based on the principle of Diminishing Musharakah and Ijarah. The Diminishing Musharakah transaction is based on Shirkat-ul-Milk where you and the Bank participate in ownership of a property. The share of the bank is then leased to you on the basis of Ijarah and is divided into a number of units. It is then agreed that you will buy the units of the bank periodically, thereby increasing your own share till all the units of the Bank are purchased by you which will make you the sole owner of the property. Till that time, you pay the Bank rent for its units leased to you. The rent keeps on decreasing as your ownership in the property increases and that of the Bank decreases.

Benefits:

Quick Processing

Flexibility to make partial prepayments

Flexible & affordable installments

Clubbing of family income

No negative area

To Understand the Difference between Diminishing Musharakah and Conventional Long Term Financing kindly click the link

- You will approach BankIslami and inform about your needs of financing for Home Purchase, Construction, Renovation or Balance transfer facility.

- You will then submit the filled Application Form along with the required documents and a cheque for processing fee. Our Business Executive will guide you during the whole process.

- The Bank will conduct verification of your residence & office addresses as well as those of the references provided by you.

- The Bank will then conduct your Income estimation to determine the maximum financing that can be provided to you.

- In case you are Self Employed, our agent will approach you for the necessary income details and documents.

- In case you are Salaried, we will approach your employer for this purpose.

- A legal opinion is then obtained by the Bank on the property documents submitted by you. Valuation of the property is done to determine its Market value.

- The Bank then issues you an offer letter for the financing amount you qualified for based on your evaluation.

- After your acceptance, a Shirkat-ul-Milk (Musharaka) Agreement is signed between you and the Bank, whereby, the Bank and you will become joint owners (partners) in the Musharakah property.

- A Pay Order is issued in the name of the seller in case of MUSKUN Home purchase by the bank. Your Business Executive and our in house / External lawyer will accompany you for the transfer of property in your name. The Pay Order is then handed over to the seller. In case of MUSKUN Home Construction / Renovation / Replacement cases, the financing amount is simply credited to your account. It is ensured through Shariah-compliance checks that the funds are utilized only for construction/renovation/replacement.

- You and the Bank also execute a Monthly Payment Agreement whereby you agree to pay a monthly payment to the Bank for the use of the bank’s ownership in home.

- Undertaking to Purchase is given by you, under which you undertake to purchase the Musharakah Units (representing Bank’s undivided ownership share in the property) from the Bank periodically.

- On monthly basis, you purchase Musharakah units from the Bank. When you have purchased all units of Bank, you become the sole owner with a free and clear title to your home.

- When you have purchased all units of Bank, you become the sole owner with a free and clear title to your home

BankIslami’s commitment to Shariah is strict and absolute. Muskun Home financing products are approved and verified by our Shariah Board. To view our Shariah Board’s approval of Muskun Home Financing products, click on the following:

| Citizenship | Pakistani |

| Cities | All major cities where BankIslami Pakistan Limited Branch exist. |

| Age Limit | Salaried/Businessmen/Selected Professionals: Salaried Primary Applicant: 25-60 Years Businessmen Primary Applicant: 25-65 Years Co- Applicant: 21-70 Years NRPs: Max 60 years old at the time of Maturity. |

| Employment Tenure | Salaried: Minimum 6 months at current employment and 2 years continuous employment experience in the same industry/field. Businessmen: 3 years of business / practice. |

| Minimum Income | Salaried: Rs. 60,000/- NRPs: Rs. 80,000/- (The respective foreign currency must be equivalent to this amount) |

| Additional Criteria for NRPs | 1. An NRP needs to have a Co-applicant residing in Pakistan as an Authorized Person on behalf of the NRP. 2. Only Salaried NRPs can avail MUSKUN Home Financing. |

Documents Required

General

Copy of CNIC (Applicant and Co-applicant)

2 passport size photographs (Applicant and Co-applicant)

Completely filled Application form with Applicant’s Profile Report

Copies of Last 6 months paid utility bills

Property Documents

Copy of chain of all title documents

Approved Building plan

Public notice

For Salaried Persons

Employment certificate issued by employer

Last three Salary Slips

Bank Statement of last 12 months

Detail of other financing along with its repayment

For Businessmen

Income tax return for last three years , Proprietorship Letter/Partnership ded/ Memorandum and Articles of Association

Company Bank Statement of last 12 months

Detail of other financing along with its repayment

For NRPs

We offer NRPs (only Salaried segment) purchase/construct/renovate/balance transfer facility of a House/Property only in Pakistan only

Last three months Salary Slip

Copy of Passport

Copy of NICOP

VISA/residential status proof

Tax deduction details

Employment Certificate and Contract Copy

Bank Letter and Banks Statement of last 12 months

2 passport-sized colored Photographs of Applicant / Co-Applicant

All the above mentioned documents relating to NRP should be duly attested by Pakistani Consulate

Q. What are the minimum and maximum financing limit for MUSKUN-Islami Home Financing?

Home Construction: Rs. 200K – 150M

Q. What is the minimum and maximum tenure being offered by BankIslami?

Home Construction: 2-25 Years

Q. What condition would apply in case of Co-applicant case?

Co-applicant must be member of the immediate family i.e. Spouse, Parents & Children (under 21) Brother and Sister (unmarried).

Q. Which areas are considered “positive” for MUSKUN-Islami Home Financing?

No negative area is marked by BankIslami for MUSKUN-Islami Home Financing

Q. What is charged if pre-mature payment (early payment or termination) of MUSKUN-Islami Home Financing is done?

In case any pre-mature payment is done, Bank will sell the Musharakah units as follows:

• 5% if the Facility is settled in the 1st Year

• NIL if the Facility is settled after the 1st Year

Q. Who will assess the value of property?

We have our approved valuators for this purpose

Q. Will my spouse’s income also be considered?

Yes, 100% of your spouse’s income (Wife or Husband) can be clubbed for Debt burden calculation. In addition 50% of your sibling’s income can also be clubbed for Debt burden calculation

Q. In case of Muskun Home Construction financing, will I get the total financing amount at the same time?

No, The Bank will disburse the payment in tranches (Maximum 4 tranches) as per BOQ (Bill of Quantity) provided by you

Q. Will BankIslami provide me financing for commercial purposes for example building a commercial plaza?

MUSKUN Home Financing is a Consumer-financing product and is only meant for residential purposes

Q. What are the application form & processing charges?

Please refer to SOC

Thinking of remodelling your kitchen to fulfill your wife’s long awaited wish, or build a study area for your kids, or a cozy library for your parents, or just want to give your home a new look? you plan it, we’ll help you renovate it.

| Construction Tenure | Maximum 6 months |

| Financing Tenure | 2-10 Years |

| Financing Range | Rs. 150K –10M |

| Bank Investment Ratio | Maximum up to 75% for salaried Maximum up to 75% for SEP * (* Doctors, Engineers, Architectures, Chartered Accountants) Maximum up to 75% for Business persons/NRPs |

| Prepayment Option available | 5% if the Facility is settled in the 1st Year

NIL if the Facility is settled after the 1st Year |

The MUSKUN Home financing facility is based on the principle of Diminishing Musharakah and Ijarah. The Diminishing Musharakah transaction is based on Shirkat-ul-Milk where you and the Bank participate in ownership of a property.

The share of the bank is then leased to you on the basis of Ijarah and is divided into a number of units. It is then agreed that you will buy the units of the bank periodically, thereby increasing your own share till all the units of the Bank are purchased by you which will make you the sole owner of the property.

Till that time, you pay the Bank rent for its units leased to you. The rent keeps on decreasing as your ownership in the property increases and that of the Bank decreases.

Benefits:

Quick Processing

Flexibility to make partial prepayments

Flexible & affordable installments

Clubbing of family income

No negative area

To Understand the Difference between Diminishing Musharakah and Conventional Long Term Financing kindly click the link

- You will approach BankIslami and inform about your needs of financing for Home Purchase, Construction, Renovation or Balance transfer facility.

- You will then submit the filled Application Form along with the required documents and a cheque for processing fee. Our Business Executive will guide you during the whole process.

- The Bank will conduct verification of your residence & office addresses as well as those of the references provided by you.

- The Bank will then conduct your Income estimation to determine the maximum financing that can be provided to you.

- In case you are Self Employed, our agent will approach you for the necessary income details and documents.

- In case you are Salaried, we will approach your employer for this purpose.

- A legal opinion is then obtained by the Bank on the property documents submitted by you. Valuation of the property is done to determine its Market value.

- The Bank then issues you an offer letter for the financing amount you qualified for based on your evaluation.

- After your acceptance, a Shirkat-ul-Milk (Musharaka) Agreement is signed between you and the Bank, whereby, the Bank and you will become joint owners (partners) in the Musharakah property.

- A Pay Order is issued in the name of the seller in case of MUSKUN Home purchase by the bank. Your Business Executive and our in house / External lawyer will accompany you for the transfer of property in your name. The Pay Order is then handed over to the seller. In case of MUSKUN Home Construction / Renovation / Replacement cases, the financing amount is simply credited to your account. It is ensured through Shariah-compliance checks that the funds are utilized only for construction/renovation/replacement.

- You and the Bank also execute a Monthly Payment Agreement whereby you agree to pay a monthly payment to the Bank for the use of the bank’s ownership in home.

- Undertaking to Purchase is given by you, under which you undertake to purchase the Musharakah Units (representing Bank’s undivided ownership share in the property) from the Bank periodically.

- On monthly basis, you purchase Musharakah units from the Bank. When you have purchased all units of Bank, you become the sole owner with a free and clear title to your home.

- When you have purchased all units of Bank, you become the sole owner with a free and clear title to your home

BankIslami’s commitment to Shariah is strict and absolute. Muskun Home financing products are approved and verified by our Shariah Board. To view our Shariah Board’s approval of Muskun Home Financing products, click on the following:

| Citizenship | Pakistani |

| Cities | All major cities where BankIslami Pakistan Limited Branch exist. |

| Age Limit | Salaried/Businessmen/Selected Professionals: Salaried Primary Applicant: 25-60 Years Businessmen Primary Applicant: 25-65 Years Co- Applicant: 21-70 Years NRPs: Max 60 years old at the time of Maturity. |

| Employment Tenure | Salaried: Minimum 6 months at current employment and 2 years continuous employment experience in the same industry/field. Businessmen: 3 years of business / practice. |

| Minimum Income | Salaried: Rs. 60,000/- NRPs: Rs. 80,000/- (The respective foreign currency must be equivalent to this amount) |

| Additional Criteria for NRPs | 1. An NRP needs to have a Co-applicant residing in Pakistan as an Authorized Person on behalf of the NRP. 2. Only Salaried NRPs can avail MUSKUN Home Financing. |

Documents Required

General

Copy of CNIC (Applicant and Co-applicant)

2 passport size photographs (Applicant and Co-applicant)

Completely filled Application form with Applicant’s Profile Report

Copies of Last 6 months paid utility bills

Property Documents

Copy of chain of all title documents

Approved Building plan

Public notice

For Salaried Persons

Employment certificate issued by employer

Last three Salary Slips

Bank Statement of last 12 months

Detail of other financing along with its repayment

For Businessmen

Income tax return for last three years , Proprietorship Letter/Partnership ded/ Memorandum and Articles of Association

Company Bank Statement of last 12 months

Detail of other financing along with its repayment

For NRPs

We offer NRPs (only Salaried segment) purchase/construct/renovate/balance transfer facility of a House/Property only in Pakistan only

Last three months Salary Slip

Copy of Passport

Copy of NICOP

VISA/residential status proof

Tax deduction details

Employment Certificate and Contract Copy

Bank Letter and Banks Statement of last 12 months

2 passport-sized colored Photographs of Applicant / Co-Applicant

All the above mentioned documents relating to NRP should be duly attested by Pakistani Consulate

Q. What are the minimum and maximum financing limit for MUSKUN-Islami Home Financing?

Home Renovation: Rs. 150K – 10M

Q. What is the minimum and maximum tenure being offered by BankIslami?

Home Renovation: 2-10 Years

Q. What condition would apply in case of Co-applicant case?

Co-applicant must be member of the immediate family i.e. Spouse, Parents & Children (under 21) Brother and Sister (unmarried).

Q. Which areas are considered “positive” for MUSKUN-Islami Home Financing?

No negative area is marked by BankIslami for MUSKUN-Islami Home Financing

Q. What is charged if pre-mature payment (early payment or termination) of MUSKUN-Islami Home Financing is done?

In case any pre-mature payment is done, Bank will sell the Musharakah units as follows:

• 5% if the Facility is settled in the 1st Year

• NIL if the Facility is settled after the 1st Year

Q. Who will assess the value of property?

We have our approved valuators for this purpose

Q. Will my spouse’s income also be considered?

Yes, 100% of your spouse’s income (Wife or Husband) can be clubbed for Debt burden calculation. In addition 50% of your sibling’s income can also be clubbed for Debt burden calculation

Q. Will BankIslami provide me financing for commercial purposes for example building a commercial plaza?

MUSKUN Home Financing is a Consumer-financing product and is only meant for residential purposes

Q. What are the application form & processing charges?

Please refer to SOC

Don’t lay the foundation of your Dream home on interest. If you already have a Conventional Mortgage loan and want to switch to Shariah compliant means of Financing, we’ll help you transfer it.

| Financing Tenure | 2-25 Years |

| Financing Range | Rs. 200K – 150M |

| Bank Investment Ratio | Maximum up to 75% for salaried Maximum up to 75% for SEP * (* Doctors, Engineers, Architectures, Chartered Accountants) Maximum up to 75% for Business persons/NRPs |

| Prepayment Option available | 5% if the Facility is settled in the 1st Year

NIL if the Facility is settled after the 1st Year |

The MUSKUN Home financing facility is based on the principle of Diminishing Musharakah and Ijarah. The Diminishing Musharakah transaction is based on Shirkat-ul-Milk where you and the Bank participate in ownership of a property.

The share of the bank is then leased to you on the basis of Ijarah and is divided into a number of units. It is then agreed that you will buy the units of the bank periodically, thereby increasing your own share till all the units of the Bank are purchased by you which will make you the sole owner of the property.

Till that time, you pay the Bank rent for its units leased to you. The rent keeps on decreasing as your ownership in the property increases and that of the Bank decreases.

Benefits:

Benefits:

Quick Processing

Flexibility to make partial prepayments

Flexible & affordable installments

Clubbing of family income

No negative area

To Understand the Difference between Diminishing Musharakah and Conventional Long Term Financing kindly click the link

- You will approach BankIslami and inform about your needs of financing for Home Purchase, Construction, Renovation or Balance transfer facility.

- You will then submit the filled Application Form along with the required documents and a cheque for processing fee. Our Business Executive will guide you during the whole process.

- The Bank will conduct verification of your residence & office addresses as well as those of the references provided by you.

- The Bank will then conduct your Income estimation to determine the maximum financing that can be provided to you.

- In case you are Self Employed, our agent will approach you for the necessary income details and documents.

- In case you are Salaried, we will approach your employer for this purpose.

- A legal opinion is then obtained by the Bank on the property documents submitted by you. Valuation of the property is done to determine its Market value.

- The Bank then issues you an offer letter for the financing amount you qualified for based on your evaluation.

- After your acceptance, a Shirkat-ul-Milk (Musharaka) Agreement is signed between you and the Bank, whereby, the Bank and you will become joint owners (partners) in the Musharakah property.

- A Pay Order is issued in the name of the seller in case of MUSKUN Home purchase by the bank. Your Business Executive and our in house / External lawyer will accompany you for the transfer of property in your name. The Pay Order is then handed over to the seller. In case of MUSKUN Home Construction / Renovation / Replacement cases, the financing amount is simply credited to your account. It is ensured through Shariah-compliance checks that the funds are utilized only for construction/renovation/replacement.

- You and the Bank also execute a Monthly Payment Agreement whereby you agree to pay a monthly payment to the Bank for the use of the bank’s ownership in home.

- Undertaking to Purchase is given by you, under which you undertake to purchase the Musharakah Units (representing Bank’s undivided ownership share in the property) from the Bank periodically.

- On monthly basis, you purchase Musharakah units from the Bank. When you have purchased all units of Bank, you become the sole owner with a free and clear title to your home.

- When you have purchased all units of Bank, you become the sole owner with a free and clear title to your home

BankIslami’s commitment to Shariah is strict and absolute. Muskun Home financing products are approved and verified by our Shariah Board. To view our Shariah Board’s approval of Muskun Home Financing products, click on the following:

| Citizenship | Pakistani |

| Cities | All major cities where BankIslami Pakistan Limited Branch exist. |

| Age Limit | Salaried/Businessmen/Selected Professionals: Salaried Primary Applicant: 25-60 Years Businessmen Primary Applicant: 25-65 Years Co- Applicant: 21-70 Years NRPs: Max 60 years old at the time of Maturity. |

| Employment Tenure | Salaried: Minimum 6 months at current employment and 2 years continuous employment experience in the same industry/field. Businessmen: 3 years of business / practice. |

| Minimum Income | Salaried: Rs. 60,000/- NRPs: Rs. 80,000/- (The respective foreign currency must be equivalent to this amount) |

| Additional Criteria for NRPs | 1. An NRP needs to have a Co-applicant residing in Pakistan as an Authorized Person on behalf of the NRP. 2. Only Salaried NRPs can avail MUSKUN Home Financing. |

Documents Required

General

Copy of CNIC (Applicant and Co-applicant)

2 passport size photographs (Applicant and Co-applicant)

Completely filled Application form with Applicant’s Profile Report

Copies of Last 6 months paid utility bills

Property Documents

Copy of chain of all title documents

Approved Building plan

Public notice

For Salaried Persons

Employment certificate issued by employer

Last three Salary Slips

Bank Statement of last 12 months

Detail of other financing along with its repayment

For Businessmen

Income tax return for last three years , Proprietorship Letter/Partnership ded/ Memorandum and Articles of Association

Company Bank Statement of last 12 months

Detail of other financing along with its repayment

For NRPs

We offer NRPs (only Salaried segment) purchase/construct/renovate/balance transfer facility of a House/Property only in Pakistan only

Last three months Salary Slip

Copy of Passport

Copy of NICOP

VISA/residential status proof

Tax deduction details

Employment Certificate and Contract Copy

Bank Letter and Banks Statement of last 12 months

2 passport-sized colored Photographs of Applicant / Co-Applicant

All the above mentioned documents relating to NRP should be duly attested by Pakistani Consulate

Q. What are the minimum and maximum financing limit for MUSKUN-Islami Home Financing?

Balance Transfer (Replacement): Rs. 200K – 150M

Q. What is the minimum and maximum tenure being offered by BankIslami?

Home Replacement: 2-25 Years

Q. What condition would apply in case of Co-applicant case?

Co-applicant must be member of the immediate family i.e. Spouse, Parents & Children (under 21) Brother and Sister (unmarried).

Q. Which areas are considered “positive” for MUSKUN-Islami Home Financing?

No negative area is marked by BankIslami for MUSKUN-Islami Home Financing

Q. What is charged if pre-mature payment (early payment or termination) of MUSKUN-Islami Home Financing is done?

In case any pre-mature payment is done, Bank will sell the Musharakah units as follows:

• 5% if the Facility is settled in the 1st Year

• NIL if the Facility is settled after the 1st Year

Q. Who will assess the value of property?

We have our approved valuators for this purpose

Q. Will my spouse’s income also be considered?

Yes, 100% of your spouse’s income (Wife or Husband) can be clubbed for Debt burden calculation. In addition 50% of your sibling’s income can also be clubbed for Debt burden calculation

Q. Will BankIslami provide me financing for commercial purposes for example building a commercial plaza?

MUSKUN Home Financing is a Consumer-financing product and is only meant for residential purposes

Q. What are the application form & processing charges?

Please refer to SOC

Glossary: (Muskun Home Finance)

| Acronym | Description | Acronym | Description |

|---|---|---|---|

| BIPL | Bank Islami Pakistan Limited | BIR | Bank Investment Ratio |

| BOQ | Bill of Quantity | BTF | Balance Transfer Facility |

| CO | Collection Officer | C&R | Collection & Recoveries |

| CAD | Credit Administration Department | CIU | Credit Initiation Unit |

| COMPSCAN | Competitive Scan | CRO | Chief Risk Officer |

| DPD | Days Past Due | EAMU | External Agency Management Unit |

| EMI | Equal Monthly Installment | EV | External Verification |

| FAQ | Frequently Asked Questions | FMS | Financial Management System |

| FSV | Forced Sale Value | HoD | Head of Department |

| IV | Internal Verification | KYC | Know Your Customer |

| LCG | Local Corporate Group | MODTD | Memorandum Deposit of Title Deeds |

| MFA | Master Financing Agreement | MNC | Multinational Company |

| NOC | No Objection Certificate | OL | Offer Letter |

| OS | Officer Sales | PTP | Promise to Pay |

| RBR | Repayment Burden Ratio | SBP | State Bank of Pakistan |

| SCD | Shariah Compliance Department | SEP | Self-Employed Professional |

| TL | Team Lead | UMI | Unequal Monthly Installment |

Apply Now:

BankIslami is pleased to introduce an exclusive and limited-time Home Financing Facility, designed to provide our valued customers with a convenient and affordable solution to own their dream home. Under this offer, customers can avail home financing at a highly competitive rental rate of 12.99%, applicable for the first three years of the financing tenure. This attractive rate offers financial ease and helps customers manage their monthly payments comfortably during the initial years. After the completion of the three-year period, the standard rack rates will apply for the remaining financing tenure, subject to prevailing market conditions. The revised rental rates after the initial period will be as follows: Salaried Individuals: 1 Year KIBOR + 2% Self-Employed Professionals and Businessmen: 1 Year KIBOR + 3%

You can request to join BankIslami Exclusive Home Financing Offer by filling the below form:

Limited Time Offer

To Get Registered for BankIslami Exclusive Home Financing Offer

In an effort to make housing more accessible and affordable, the Government of Pakistan has launched the “Mera Ghar – Mera Ashiana (MGMA)” scheme, offering profit subsidy to support first-time home owners. BankIslami extends this facility through Muskun Home Financing, enabling individuals to construct or purchase their dream homes with ease, convenience, and complete Shariah compliance under the Diminishing Musharakah structure

· Pakistani CNIC holding citizens · First time homeowners · Not owning any housing unit in their name · Purchase of house/flat · Construction of house on already owned plot · Purchase of plot and construction of house · House of up to 5 Marla · Flat/Apartment of up to 1360 sq. ft. area · Salaried: 25 – 60 Years · SEP/ Businessmen: 25 – 65 Years

Mera Ghar Mera Ashiana (MGMA)

Mera Ghar Mera Ashiana Parameters:

Parameters

Tier 1 (up to 2 Mn Cases)

Tier 2 (Above 2 Mn up to 3.5 Mn Cases)

Eligibility Criteria

Scope

Size of Housing Unit

Maximum Financing Amount

Up to PKR 2.0 Million (Tier 1)

Above PKR 2.0 Million and up to PKR 3.5 Million (Tier 2)

Maximum Financing Tenor

20 years (subsidy for 10 years)

Age

Bank Pricing for Subsidy

Bank will claim subsidy amount being the differential of Customer pricing and prevailing 1 Year KIBOR + 3%.

Customer pricing (Initial 10 Years)

5% (Tier 1)

8% (Tier 2)

Customer pricing (After 10 to 20 Years)

One Year KIBOR + 3%

Processing Fee

Nil

Early Termination Charges

Nil

Minimum Contribution from the customer

Minimum 10%

Risk Coverage

10% of the outstanding portfolio under the scheme on first loss basis

Financing Cities

Whole of Pakistan

Monthly Income

No Upper and Lower limits on the ‚income requirement‛