National Financial Literacy Program: Empowering Financial Inclusion

BankIslami is a lead supporter of the National Financial Literacy Program (NFLP), an initiative spearheaded by the State Bank of Pakistan (SBP) to enhance financial inclusion and literacy nationwide. Financial inclusion defined as access to formal financial services such as payments, savings, credit and Takaful is pivotal for economic growth, poverty reduction and financial stability. Recognizing this, BankIslami is dedicated to equipping individuals with the knowledge and tools necessary to make informed financial decisions, thereby fostering a more inclusive and resilient economy.

The NFLP targets individuals aged 18 to 60, ensuring gender balance and addresses critical challenges such as limited awareness of financial products and barriers to their adoption. By doing so, it aims to unlock the potential of underbanked communities, stimulate innovation and enhance the competitiveness of Pakistan’s financial sector.

Our outreach strategy combines classroom sessions with situation based sessions, bringing financial education to both rural and urban communities nationwide. Participants are introduced to key concepts including budgeting, saving, investment strategies, consumer rights, branchless banking, currency management and the principles of Islamic finance. These sessions are conducted by field experts trained by NFLP Master Trainers, ensuring that educational content is relevant, accessible and impactful at a grass roots level.

Via the NFLP, BankIslami also communicates the benefits of Shariah-compliant banking solutions, highlighting the benefits of ethical, Riba-free financial practices. This dual focus on financial literacy and Islamic finance underscores our commitment to values-driven banking and sustainable economic progress.

The key objectives of the program are:

- Enhance understanding of financial concepts, products and services.

- Develop skills in budgeting, saving, investing and financial negotiations.

- Promote awareness of Riba-free banking as an ethical alternative.

By supporting the NFLP, BankIslami reinforces its commitment to financial inclusion and literacy, helping individuals make informed choices and contributing to the broader economic well-being of Pakistan.

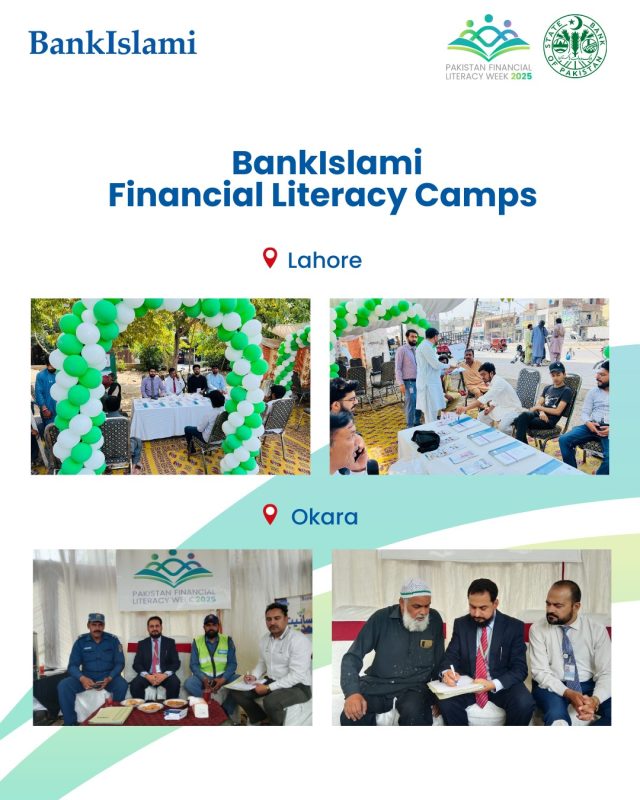

BankIslami Financial Literacy Camps Lahore & Okara:

BankIslami Financial Literacy Camps DI Khan & Khairpur:

BankIslami Financial Literacy Camps Loralai & Ghotki:

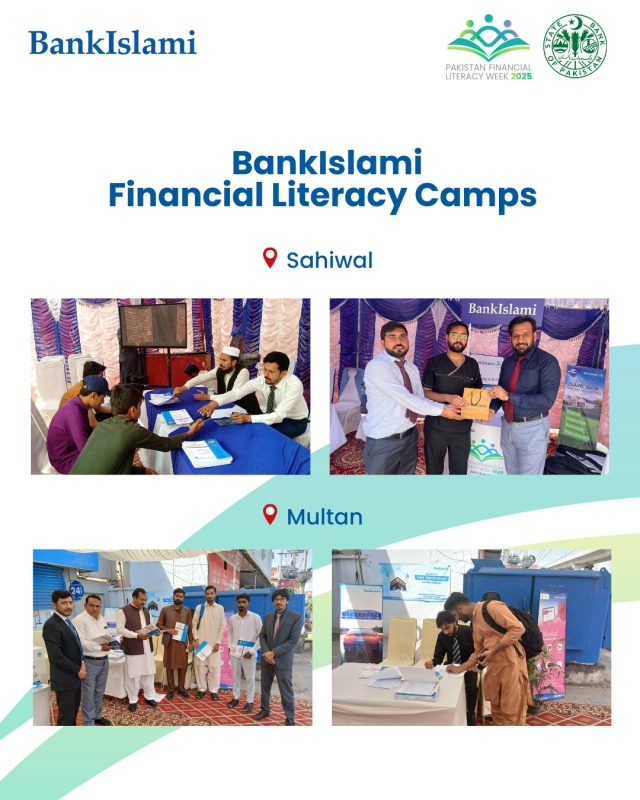

BankIslami Financial Literacy Camps Sahiwal & Multan: