- Debit Cards

- One Touch Banking

- آن لائن بینکنگ

- Digital Banking

- IBFT

- انٹرنیٹ بینکنگ

- Contact Center

- Card Discounts

- 1Bill

- Digital Onboarding

- Raast

- SMS Services

- ATM & CCDM

Whenever and wherever you are

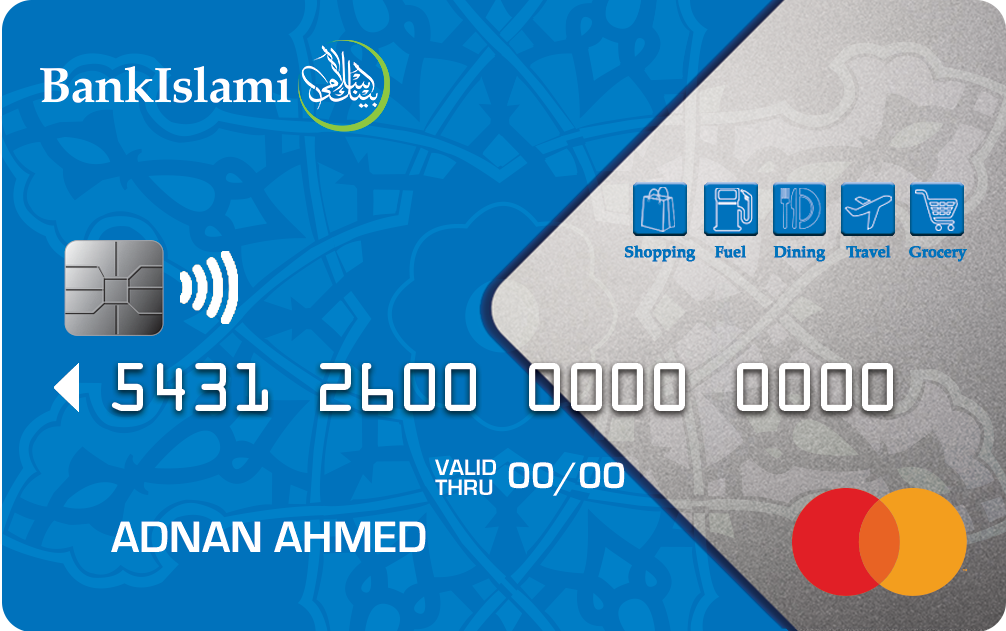

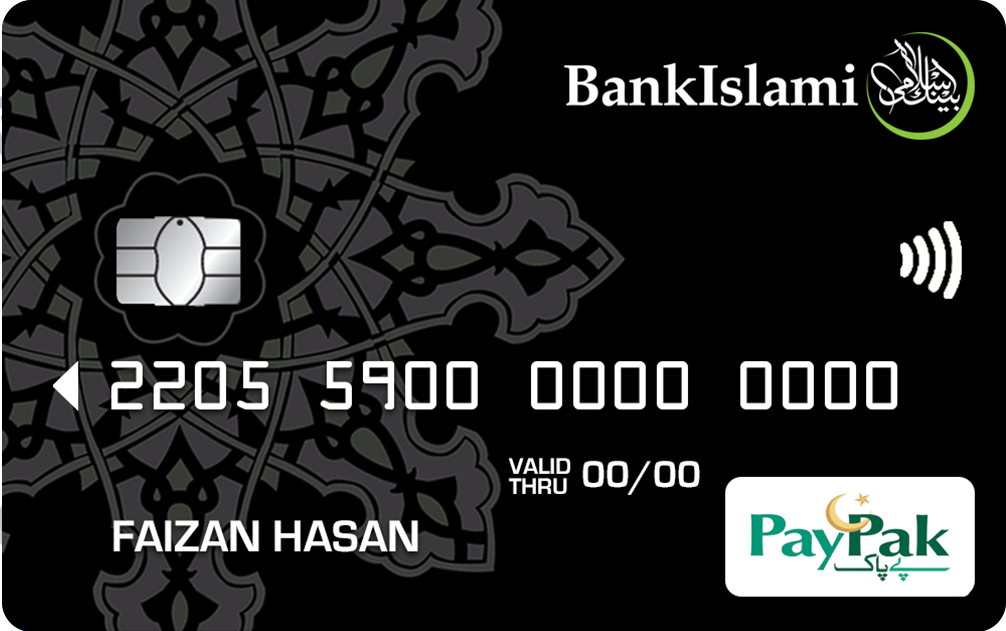

Welcome to the world of BankIslami Debit Cards, the most exciting and vibrant card brand in Pakistan. We offer you a range of innovative and exciting cards that have all the convenience and security you desire and the quality you deserve. BankIslami Debit Cards are a dual interface enabled card; supporting NFC (contactless) and EMV/Chip technology, thus ensuring the utmost security of your debit card along with the convenience of tap and pay facility. BankIslami Debit Cards are accepted at over 50,000 merchants, and over 14,000 ATMs nationwide in Pakistan and millions of merchant location and ATMs globally.

Fast, safe and convenient way to pay with BankIslami

BankIslami offers variety of Debit Cards suiting your needs

BankIslami Titanium Debit Mastercard

BankIslami Classic Debit Mastercard

PayPak Debit Card

Pakistan’s First Biometric Banking Solution

BankIslami has been the pioneer of Biometric ATMs since its inception followed by introduction of Cardless ATMs. With the aim to serve our customers in the best way possible and ensure seamless customer experience BankIslami brings you One Touch Banking- a complete Biometric banking solution for all your banking needs which enables you to perform any transaction with just a thumb impression without needing an ATM card or chequebook. One Touch Banking has made banking easier like never before because now “Your Thumb is Your Bank”

This unique proposition focuses on convenience and value innovation which mitigates your dependency on cards and chequebooks and enables you to perform following transactions with just a thumb impression.

- Chequeless Cash withdrawal

- Chequeless Pay order issuance

- Funds Transfer

- Bills payment

- Mobile Top up

- Dormant account activation

Submission for essentials of modern marketing by Philip Kotler

Introduction:

BankIslami is the only Bank in Pakistan Banking industry that has introduced instrument less banking service for its customer(s), One Touch Banking is a Signature service of BankIslami (Cheque Less Transaction Service), by using One Touch Banking service customers can withdraw the funds, transfer the funds to other accounts/ other Bank customers, utility bills payment, Mobile Top-up, Internet Banking Activation and Mobile Application Activation services without using a Cheque or any transaction form through Thumb Impression authentication. Customer just needs to visit the branch counter and after BIO Impression verification; customer can execute any counter transaction(s).

In addition to Cheque less transaction services to customers, BankIslami is also providing Inter Bank Fund Transfer (IBFT) through Cheque via One Touch Banking channel by using this service BankIslami customers can transfer the funds from their account to any other bank customer account.

Services Offered:

- رقم نکلوانا

- Fund Transfer (Own Account)

- Fund Transfer (Third Party)

- Fund Transfer (IBFT)

- Fund Transfer (IBFT) Through Cheque

- Mobile Top-up

- Utility Bills, Internet Bills and Post Pay Bills Payment

- Pay Order Issuance.

- Dormant Account Activation

- Internet Banking and Mobile Application Activation

BankIslami’s has a wide network of 500 plus Branches in 210 plus Cities all of which provide Online Banking services. Online Banking means that all our 500 plus Branches in 210 plus Cities are connected with each other so that you can instantly access your account and make transactions in any BankIslami Branch. The following are the key benefits that you will get out of using our Online branch network:

- ََ۔دور دراز واقع برانچ میں فوری کریڈٹ کے لئے کیش ڈیپازٹ

- ۔کسی بھی آن لائن برانچ سے ریموٹ چیک کیش ان کیشمنٹ

- Instant Funds Transfer between any two Online branches.

- ۔کسی بھی آن لائن برانچ سے بیلنس کی معلومات اور اکاؤنٹ اسٹیٹمنٹ

تفصیلات کے لئے براہ کرم ملاحظہ کیجئے (یہاں کلک کریں) (Click Here)

e-Statement is a facility that not only helps you in viewing their statements whenever and wherever required but also brings an end to filing the Statements and keeping a paper stack. It is a convenience that offers you ease of use along with a worldwide access to your banking transactions.

رجسٹریشن کس طرح کی جائے؟

- Call 021-111-ISLAMI (475264)

- فون بینکنگ آفیسر سے بات کریں

- ای اسٹیٹمنٹ کی ایکٹیویشن کی درخواست کریں

- اکاؤنٹ کی تفصیل بتائیں

- اسٹیٹمنٹ کی حد بتائیں

دستیاب اسٹیٹمنٹ کی فریکیوئنسیز

- روزانہ

- ہفتہ وار

- ماہانہ

- 6 ماہ

-

Monday – Thursday صبح 9 بجے سے شام 5:30 بجے جمعہ صبح 09:00 بجے سے شام 05:30 بجے ہفتہ صبح 10:00 بجے سے دوپہر 02:00 بجے

- ای اسٹیٹمنٹس ایک الیکٹرانک اسٹیٹمنٹ ہے جو آپ کے ای میل ایڈریس پر بھیجی جاتی ہے۔

ای اسٹیٹمنٹ سروس کی کیا قیمت ہے؟

- ای اسٹیٹمنٹ سروس پر کوئی سروس چارجز نہیں۔

کیا میں دنیا میں کسی بھی جگہ سے ای اسٹیٹمنٹ تک رسائی حاصل کر سکتا ہوں؟

- جی ہاں، اگر آپ کو کسی بھی مقام سے آپ کی ای میل تک رسائی حاصل ہو تو آپ اپنی ای اسٹیٹمنٹ کو دیکھ سکتے ہیں۔

مجھے ای اسٹیٹمنٹس کب موصول ہوتی ہیں؟

- آپ اپنی بتائی گئی فریکیونسی کے مطابق اپنی ای اسٹیٹمنٹ موصول کریں گے، بینک اکاؤنٹ صارف کی فریکیونسی روزانہ، ہفتہ وار یا 6 ماہ کی ہو سکتی ہے۔

کیا میں ای اسٹیٹمنٹس استعمال کر سکتا ہوں اور ریگولر ای میل پر اپنی اسٹیٹمنٹس بھی موصول کر سکتا ہوں؟

- جی ہاں، بینک اکاؤنٹ صارف اپنی اسٹیٹمنٹس دونوں ریگولر میل اور بذریعہ ای اسٹیٹمنٹ موصول کر سکتا ہے۔

کیا میں ای اسٹیٹمنٹس استعمال کر سکتا ہوں اور ریگولر ای میل پر اپنی اسٹیٹمنٹس بھی موصول کر سکتا ہوں؟

- Yes, you can simply call phone Banking at 021-111-ISLAMI (475264)

ایسا کیوں ہوتا ہے کہ رجسٹریشن کے بعد مجھے اپنی بتائی ہوئی فریکیونسی پر ای اسٹیٹمنٹس نہیں ملتیں؟

- Kindly ensure that your email inbox has free space. Check if the eStatement is lying in the junk mail box and the email address that you have specified is correct. After completing the above checks if the problem persists call at 021-111-ISLAMI (475264)

کیا مجھے اپنی ای اسٹیٹمنٹ دیکھنے کے لئے کسی سافٹ ویئر کی ضرورت ہے؟

- جی نہیں، آپ کو ایس اسٹیٹمنٹ سروس سے مستفید ہونے کے لئے کسی خاص سافٹ ویئر کی ضرورت نہیں۔ ای اسٹیٹمنٹ پی ڈی ایف فارمیٹ پر ہوتی ییں اور ایڈوب ایکروبیٹ ریڈر پر کھل جاتی ہیں۔

کیا میں ایک سے زائد اکاؤنٹ پر ای اسٹیٹمنٹ ڈلیوری حاصل کر سکتا ہوں؟

- جی ہاں، آپ اپنے ای میل پر بینک اسلامی کے مختلف اکاؤنٹس کی ای اسٹیٹمنٹس حاصل کر سکتے ہیں۔

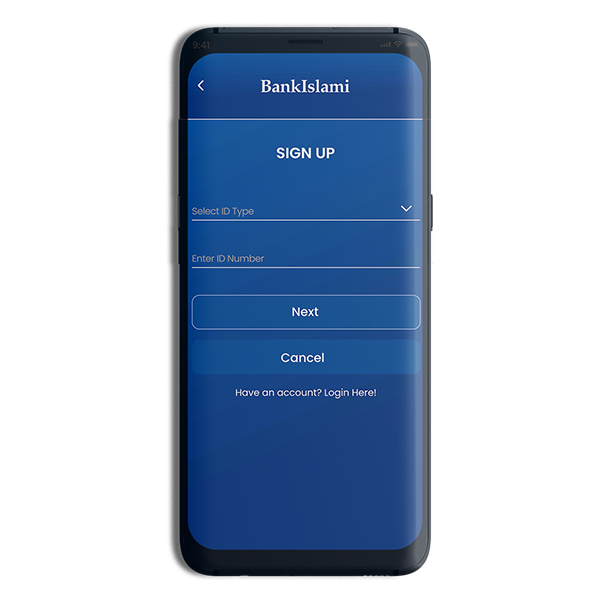

BankIslami aims to provide you with a quick and hassle-free banking experience. Offering a user-friendly interface, the app brings your banking needs to your fingertips, allowing you to experience a new era of banking with convenience and reliability. Simply log in with your account or register to enjoy a secure and fast experience. Security Enhancements: Security features have been integrated to ensure the protection of users’ data. Special password protection and advanced security measures, such as “Mobile App Root Detection,” have been implemented for an added layer of protection. New and Improved Layout: The user interface has been redesigned for smooth usage on both iOS and Android, making the App more intuitive and user-friendly. New Functionalities: Card Transaction History: Easily view your past transactions. Raast P2M (Payment to Merchant): A seamless way to make payments directly to merchants. Instant Fund Transfer: Transfer money instantly to any account. Device Management: Choose between a primary or secondary device for account access. Account Management: Register or delete your account with ease. iOS Features: Includes Face ID for secure and quick access. Debit Card PIN Change & Card Deactivation: Securely update your PIN or deactivate your card whenever needed. Domestic e-Commerce Enable/Disable: Take control of your local online spending with a simple toggle. International e-Commerce Activate/Deactivate: Easily manage your card’s ability to make international online payments Login or Registration Method: For Biometric Verification: The application now offers a robust biometric mechanism. Users will be required to scan four fingers by clicking the “Snap” button and then scan their thumbs for verification. For users with disabilities or abnormal marks on their fingerprints, they can upload the required documents to complete the verification process quickly and efficiently. Biometric (finger/thumb) Steps 1) Login with user ID/password. 2) Register using NADRA verification. 3) Left/Right finger or thumb scanning. 4) Verification done Liveliness (picture and CNIC) Steps 1) Login with user ID/password. 2) Document verification. 3) Face snap. 4) CNIC front/back image.

Whatever your inclination, BankIslami offers advantageous ways of aiding you the manner in which you need.

BankIslami Mobile App – Experience Seamless and Secure Banking!

Key Features and Security Add-ons:

Ways To Bank

Feature:

کیا آپ اپنے دوستوں، خاندان، ساتھیوں اور کارباری ساتھیوں کو آسانی اور سہولت دینا چاہتے ہیں ہیں، ہمارے انٹر بینک فنڈز ٹرانسفر ( IBFT) کی سہولت کے ذریعے آپ اپنے اے ٹی ایم کے ذریعے ان کے اکاؤنٹس میں بآسانی فنڈز ٹرانسفر کر سکتے ہیں۔ اب ، آپ کے ساتھ ڈیلنگ کرتے ہوئے وہ بغیر کسی پریشانی اپنے اکاؤنٹس میں فنڈز کی منتقلی یقینی بنا سکتے ہیں۔ چیک کلیئرنس کے لئے انتظار کی پریشانی یا برانچ میں جا کر کیش یا چیک ڈیپازٹ کرانے کی ضرورت نہیں۔

آئی بی ایف ٹی کی سہولت سے آپ 1 لنک آئی بی ایف ٹی کے رکن بینکس کے کسی بھی اکاؤنٹ ہولڈر کو آن لائن فنڈز بھیج اور وصول بھی کر سکتے ہیں۔ درج ذیل وہ اہم فوائد ہیں جو آئی بی ایف ٹی کی سہولت کے استعمال سے آپ کو ملیں گے۔

- ۔سہولت

- ۔ استعمال میں آسان

- ۔ فوری منتقلی ، آن لائن

- ۔ محفوظ

- 7×24 Facility- Round the Clock

- ۔ آئی بی ایف ٹی چیکس کے استعمال کا مکمل خاتمہ کرتا ہے اور آن لائن ٹرانزیکشنز پر عمل درآمد کیا جا سکتا ہے۔

How to do IBFT via ATM?:

- ۔اے ٹی ایم میں کارڈ ڈالیں

- Wait for Authentication – using Biometric or PIN

- Select “Funds Transfer” from Main Menu

- Select “IBFT” from Funds Transfer Menu

- ْْ۔ اکاؤنٹ سے منتخب کریں جس میں فنڈز منتقل کرنے ہیں

- ۔ بینک منتخب کریں جہاں فنڈز منتقل کرنے یں

- ۔ مستفید ہونے والے کا اکاؤنٹ نمبر ڈالیں

- رقم درج کریں

- ۔بینیفشری بینک سے آن لائن بینیفشری نام کی توثیق کریں۔ ٹرانزیکشن کی تصدیق کریں۔

Don’t get in line. Go online. Experience reliable, convenient and secure banking services with BankIslami.

Login iBankIslami: https://ib.bankislami.com.pk/

Phone Banking: We are just a call away! We are there for you 24 hours a day, 7 days a week. We don’t even take breaks on Holidays and Sundays. If you need any information on any of our Products & Services, If you need to lodge a complaint or if you just need to give feedback on any of our Products or Services, just dial 021-111-ISLAMI (475264). ہم وعدہ کرتے ہیں کہ آپ کو اسی معیار کی ذاتی خدمت اور توجہ ملے گی جو آپ ہماری برانچز سے توقع کرتے ہیں۔ You may choose to speak to us at anytime, Just Dial 021-111-ISLAMI (475264). Self Service Banking: خصوصیات BankIslami offers Banking at your finger tips. Forget about rushing off to the Bank during office hours or waiting in queues – switch to Banking that’s quick, secure and so very convenient. BankIslami Self Service facility provides you the convenience and ease of making transactions or getting your account details by just making a call to 021-111-ISLAMI (475264). آپ سادہ مینیو کا انتخاب کرتے ہوئے درج ذیل فون بینکنگ سیلف سروس کی سہولتیں حاصل کر سکتے ہیں۔

At BankIslami, we recognize the importance of delivering banking services that are not only comprehensive but also convenient for our valued customers. Our Interactive Voice Response (IVR) services serve as a cornerstone for achieving this goal, providing a user-friendly platform that facilitates a range of essential banking transactions. Below are the key services offered through our IVR system, designed to enhance consumer convenience and ensure a seamless banking experience:

ATM Card Activation: Customers can conveniently activate their ATM cards through the IVR system, allowing for a hassle-free onboarding process. ATM Card Block Service: In the event of a lost or stolen ATM card, customers can promptly block their cards using the IVR services to prevent unauthorized transactions. Balance Inquiry: Our IVR system empowers customers to inquire about their account balances swiftly, providing real-time information at their fingertips. ATM PIN Change: Customers can change their ATM PINs securely and conveniently through the IVR system, ensuring the safety of their accounts. Digital Services Block: In situations where customers need to secure their digital services, such as mobile apps and internet banking, the IVR system offers a quick and reliable blocking mechanism. Mini Statement: The IVR system provides customers with the flexibility to request mini statements, offering a snapshot of recent transactions and account activities. Advantages of IVR Services for Consumer Convenience: By leveraging the capabilities of our IVR services, BankIslami is committed to providing a banking experience that aligns with the modern lifestyle of our customers. Our IVR offerings aim to empower customers with accessible, secure, and efficient banking solutions, reinforcing our dedication to consumer convenience and technological innovation.

Interactive Voice Response Services: Empowering Seamless Banking at BankIslami

Exciting discounts & privileges with BankIslami Debit Cards!

Get ready for amazing savings and enjoyable shopping with our fantastic discounts! Discover the best deals at your favorite places,

making your shopping experience even more delightful and affordable!

1Bill

1Bill is an electronic bill payments services to allow the consumer to pay all types government duties, credit card and loan payment bills by using 1Bill Prefix/Billing Partner name.

Click here for 1Bill biller Prefix/Billing Partner Name.

BankIslami Digital Onboarding – OPEN YOUR ACCOUNT ANYWHERE ANY TIME To access BankIslami Digital Onboarding, please visit https://onboard.bankislami.com.pk

BankIslami Digital Onboarding

BankIslami Digital Onboarding is a portal where customers can open their Accounts digitally without visiting any BankIslami Branch.Following Islami Digital Accounts are offered through BankIslami Digital Onboarding Portal:

Digital Onboarding Process

Transaction Limits

1) Islami Asaan Digital Current/Savings/Shaulat Account

2) Islami Asaan Digital Remittance Account

3) Islami Freelancer Digital Account

* Existing Limits will be applied on all remaining Digital Accounts

Live Chat

For further information, please contact 021-111-475-267

English Tutorial

Urdu Tutorial

Raast is Pakistan’s first instant payment system that enables end-to-end digital payments among individuals, businesses and government entities instantaneously. BankIslami in compliance with SBP has integrated Pakistan’s fastest payment system for their valued customers by simply using their mobile numbers as their Raast ID. Experience this secure, simple and swift digital payment!

Near-instant digital transactions between individuals, merchants, businesses, and government entities.

An affordable digital payment solution with no transaction charges

Ensures that each transaction is authorized by the payer and offers enhanced data protection and fraud detection services.

BankIslami is proud to introduce Pakistan’s first-ever Shariah-compliant Raast QR Payment Solution,

Whatever your inclination, BankIslami offers advantageous ways of aiding you the manner in which you need.

Now complete digital payments seamlessly in just seconds

Instant Payments

No Transaction Fee

Reliable and Secure

You can instantly process digital payments

offering a seamless and secure way to conduct transactions in accordance with Islamic principles.BankIslami Mobile App

آن لائن بینکنگ

Over The Counter

Ways To Bank

SMS Services

Transactional SMS on debit and credit transactions in a bank play a crucial role in keeping customers informed about their account activities in real-time. Here are the key roles and benefits:

-

- Customers receive immediate SMS notifications for every debit and credit transaction on their accounts.

- Transactional SMS adds an extra layer of security by notifying customers of any unauthorized or suspicious transactions.

- Customers can quickly identify and report any discrepancies or fraudulent activities.

- Customers can monitor their account balances and transaction history effortlessly through SMS alerts.

- This feature promotes proactive financial management and helps prevent overdrawing or overspending.

- Customers can quickly check recent transactions and account balances on the go.

- In case of transaction errors or declined transactions, customers are promptly notified via SMS.

- Transactional SMS contributes to an improved customer experience by keeping customers informed and engaged with their banking activities.

- It demonstrates the bank’s commitment to providing transparent and efficient services.

- Immediate alerts on credit transactions can prevent identity theft or unauthorized use of debit cards, allowing customers to take quick action if needed.

Overall, transactional SMS on debit and credit transactions is an integral part of modern banking services, enhancing security, customer engagement, and the overall banking experience.

ATM & CCDM

At BankIslami, our commitment to consumer convenience is exemplified through our widespread network of ATMs (Automated Teller Machines) compromises of 444 ATM’s and CCDMs (Cash and Cheque Deposit Machines) compromises of 4 CCDM’s. These technologies play a pivotal role in transforming the banking experience for our valued customers.

ATM Network:

Cash Withdrawal: Our extensive network of ATMs empowers consumers to withdraw cash conveniently at any time, providing access beyond traditional banking hours.

Balance Inquiry: Customers can check their account balances seamlessly, gaining real-time insights into their financial status.

Transaction History: ATMs facilitate easy access to transaction histories, allowing consumers to track their financial activities effortlessly.

CCDM:

Cash and Cheque Deposits: CCDMs offer a multifaceted solution, allowing consumers to deposit both cash and Cheque directly into their accounts without visiting a traditional bank branch.

Real-time Updates: The CCDM process ensures that deposited funds are promptly reflected in the consumer’s account, providing real-time updates on financial transactions.

How ATM & CCDM Support Consumer Convenience:

Accessibility:

24/7 Availability: Our ATMs and CCDMs are accessible round the clock, providing consumers with the flexibility to perform transactions at their convenience.

Reduced Depedency on Branches:

Cash Withdrawal: Consumers can withdraw cash from ATMs, reducing dependency on physical bank branches and enhancing accessibility.

Deposit Options: CCDMs minimize the need to visit branches for routine deposits, streamlining the banking process for consumers.

Time Effciency:

Quick Transactions: ATMs and CCDMs facilitate swift transactions, saving valuable time for consumers with busy schedules.

Security:

Secure Transactions: With advanced security features, consumers can trust ATMs and CCDMs for secure transactions, ensuring the safety of their financial activities.

Convenience in Remote Areas:

Extended Reach: The widespread deployment of ATMs provides banking services in remote and underserved areas, catering to a broader consumer base.

Enhanced Banking Experience:

Self-Service Options: ATMs and CCDMs offer self-service capabilities, enabling consumers to manage their finances independently.

By integrating advanced technologies like ATMs and CCDMs into our banking ecosystem, BankIslami is dedicated to fostering a banking environment that prioritizes consumer convenience, accessibility, and efficiency. As technology continues to evolve, so too will our commitment to providing innovative solutions that enhance the overall banking experience for our valued customers.